how to lower property taxes in pa

Special Session Act 1 of 2006 the Taxpayer Relief Act was signed on June 27 2006 and modified in June 2011 by Act 25 of 2011. Search Any Address 2.

Property Tax How To Calculate Local Considerations

Ad PA ABLE provides benefits for PA residents unavailable from other states ABLE accounts.

. Up to 25 cash back The county tax assessor has placed a taxable value of 400000 on the property. Your local tax collectors office sends you your property tax bill which is based on this assessment. Property TaxRent Rebate Program claimants now have the option to submit program applications online with the.

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. My property taxes seem to go up significantly every year. In order to come up with your tax bill your tax office multiplies the tax rate by.

Up to 25 cash back Beyond attempting to reduce the taxable value of your home Pennsylvania allows for reduced property taxes if the homeowner meets certain requirements. The assessed value of your homeproperty and the actual tax rates applied. Property tax reduction will be through a homestead or farmstead exclusion Generally most owner occupied homes and farms are eligible for property tax reduction.

Get Ready to Wait. In fact the state carries a 150 average effective property tax rate in. Even if you dont qualify for PA senior citizen property tax rebate you might be eligible to reduce your property tax bill in some other way.

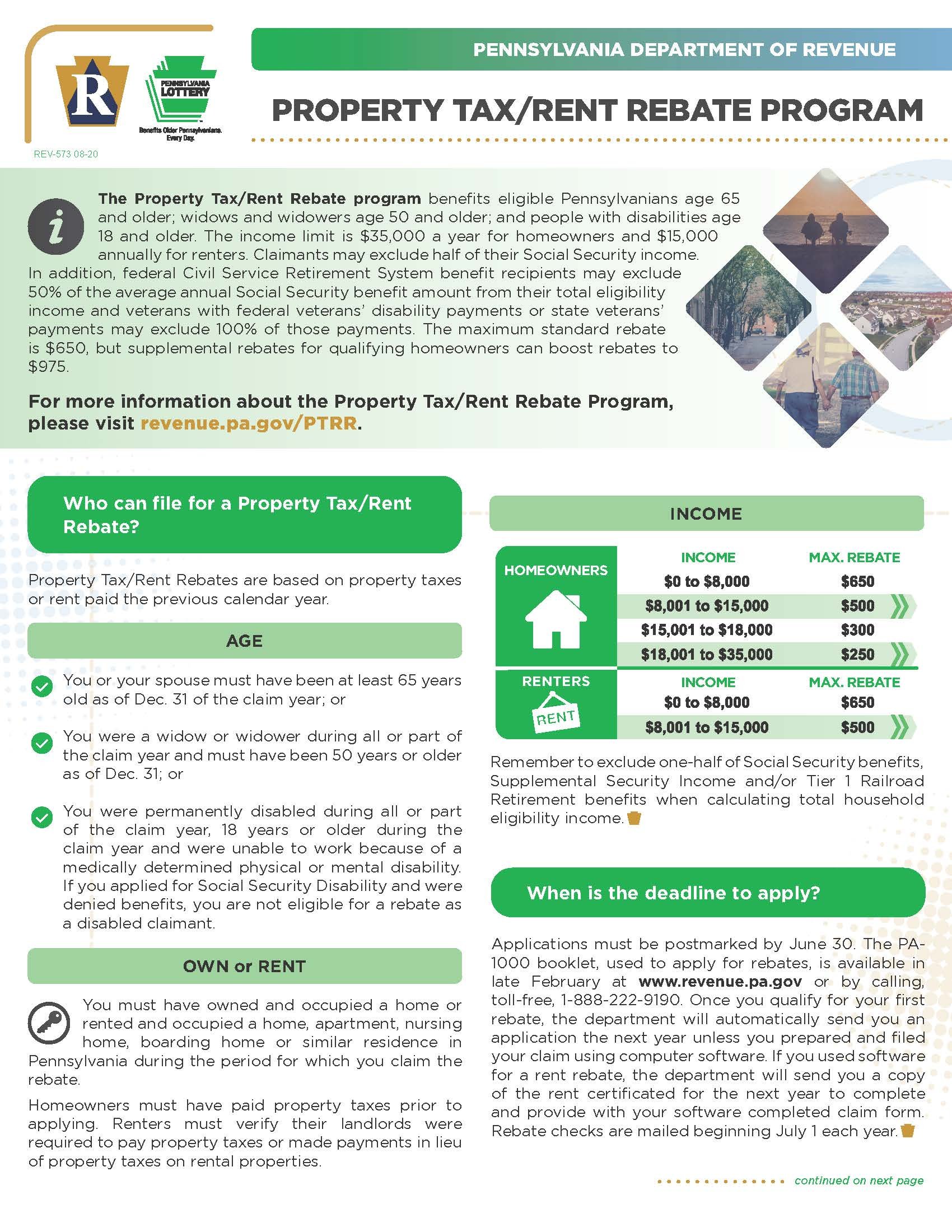

Replace property tax revenue with sales and income taxes. File Your Property Tax Appeal. Renters are restricted to 15000 in yearly income while homeowners may use the program for 35000.

Beyond attempting to reduce the taxable value of your home Pennsylvania allows for reduced property. Since the evaluation process begins in the spring you. This law eases the financial burden of.

Learn how to deduct your PA ABLE contributions on PA income taxes. When people get their annual notice of assessment in the mail. A 5reduction in your annual tax bill for example would add up to 0in.

Pennsylvania uses two different factors to calculate how much you owe in property tax. File Your Property TaxRent Rebate Program Applications Online. Find the Most Recent Comps.

According to the PA Department of Educations website the Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was created to provide property tax reduction allocations. 135 of home value. An effective way of.

Get Your Taxes Done Right With Support From An. On todays radio show you talked about the Cook County property tax appeal process. Can you help me lower my.

2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. This means that their. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

The Treasurers Office of Allegheny County administrates Senior Citizen Tax Relief. Property tax discount programs vary from county to county. The applicable tax rate and the assessed value of your home.

As a senior citizen who owns a home in this. There are two parts to your tax bill. Increase the Personal Income Tax by 185 with those funds staying local to the school district.

According to those in the know there are steps you can take to reduce the assessment of your propertys value. The local tax rate is 10 for every 1000 of taxable value. Property TaxRent Rebate programs are available to eligible Pennsylvanians aged 65 and older widows widowers or people whose disabilities are not considered by the federal government who receive at least 6000 in Property TaxRent Rebate assistance.

You can try out some of the following strategies. An effective way of saving property taxes in Pennsylvania is to enroll farmland or forest land in the Clean and Green program. Look at Your Annual Notice of Assessment.

The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000. See Property Records Tax Titles Owner Info More. Special guest Ron Myers aka The Godfather of Tax Appeals began started handling tax appeals in 1997 as a non-lawyer and brings a completely different approach to.

Pennsylvania will continue its broad-based property tax relief in 2022-23 based on Special Session Act 1 of 2006. Overall Pennsylvania has property tax rates that are higher than national averages. You can lower your property taxes in Allegheny County PA by appealing and lowering your current.

Tax amount varies by county. The tax rate is set by local officials. While you cant do anything about.

The Commonwealths Budget Secretary certified that. The best way to lower your property tax bill is to lower your property assessment value. Beyond attempting to reduce the taxable value of your home Pennsylvania allows for reduced property taxes if the homeowner meets certain requirements.

Overview of Pennsylvania Taxes.

Enjoy A Luxury Home At The Charming Hatboro Station Community In Hatboro Pa Luxury Homes Home Builders Home

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

.jpg)

Pa State Rep Property Taxes Time To Eliminate

Pennsylvania Property Tax H R Block

What Is A Homestead Exemption And How Does It Work Lendingtree

2022 Property Taxes By State Report Propertyshark

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Secured Property Taxes Treasurer Tax Collector

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Explaining Taxes To The Kids A Christian Perspective Christian Perspective Tax Homeschool

File A Principal Residence Exemption Pre To Save 900 Per Year On A 100k Property It Only Takes 5 Min Home Buying Sell Your House Fast Homeowners Insurance

What Are Personal Property Taxes Turbotax Tax Tips Videos

Deducting Property Taxes H R Block

Texans Stunned By Property Tax Hikes

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

Did Your Property Taxes Go Up Here S How To Make Your Tax Bill More Affordable

/cloudfront-us-east-1.images.arcpublishing.com/pmn/AOSJXQVTCVHSPMOI75C4M4MFM4.jpg)